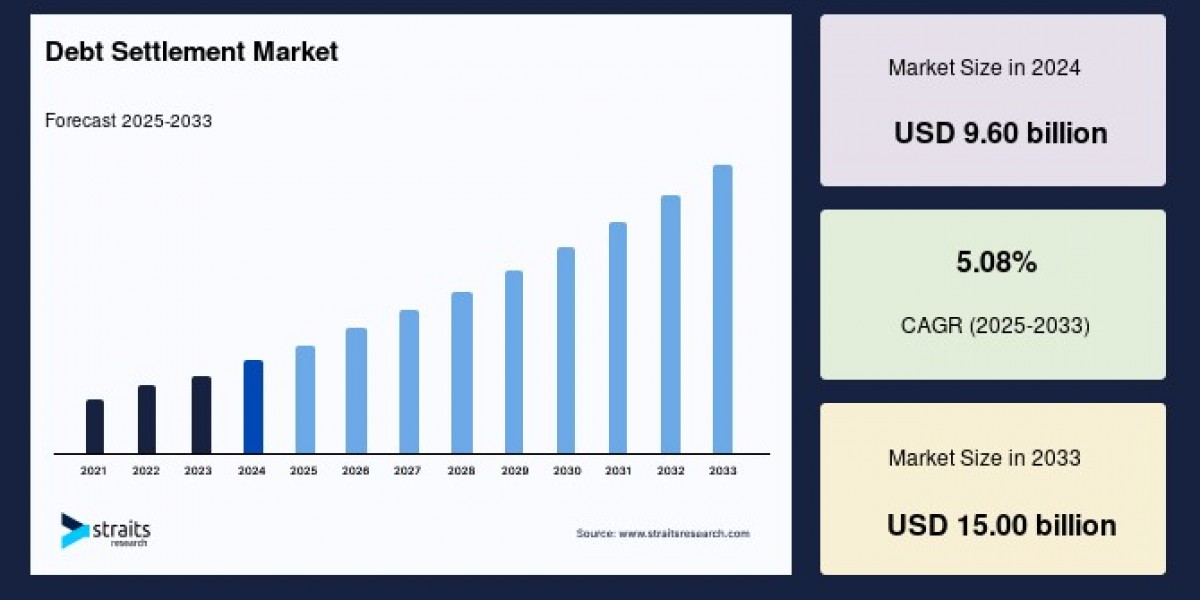

The global debt settlement market helps consumers and businesses negotiate reduced payoffs with unsecured creditors such as credit cards, medical bills, and personal loans. Rising consumer debt and tightening credit conditions have kept demand steady. The industry is estimated at around USD 9–10 billion in 2024, with forecasts showing steady growth through 2035.

Download Free Sample@ https://straitsresearch.com/report/debt-settlement-market/request-sample

Market Restraints

Regulatory scrutiny & consumer protections. Stricter enforcement and state-level rules (disclosure, escrow requirements, fee caps) increase compliance costs and limit aggressive marketing.

Reputational risk & refunds. Past abuses by some firms mean higher customer acquisition costs and cautious consumer uptake.

Alternatives gaining traction. Debt consolidation loans, balance transfers, and creditor hardship programs reduce the pool of eligible clients.

Opportunities

Technology & automation. AI-driven negotiation tools, automated document processing, and client portals reduce costs and settlement timelines.

Partnerships with fintech & lenders. Referral agreements and white-label programs create new customer funnels.

Geographic & product expansion. Growth in emerging markets and adjacent services such as financial coaching and tax advisory expand the market scope.

Market Segments

By debtor type: Individual consumers vs. small businesses.

By service model: In-house negotiators (traditional) vs. tech-enabled marketplaces and robo-negotiation.

By channel: Direct-to-consumer, B2B partnerships, and referral/affiliate networks.

By geography: North America (largest), Europe, and Asia-Pacific (high growth potential).

Key Players

Several U.S.-based providers dominate the market, with many operating as private companies and disclosing limited financials:

Freedom Debt Relief — A long-standing leader, known for large cumulative settlements and market recognition.

National Debt Relief — One of the largest providers by enrolled debt and revenue, with operations nationwide.

Accredited Debt Relief — A mid-sized competitor with strong presence in consumer settlements.

Pacific Debt Relief, Rescue One Financial, ClearOne Advantage — Recognized players with significant market shares and regional reach.

Latest Developments & Collaborations

Consolidation and recognition. Large firms highlight settlement milestones and service awards, strengthening their reputations.

Fintech partnerships. Providers are working with fintechs and lenders to offer hybrid solutions like pre-settlement escrow accounts and consolidation referrals.

Tech adoption. The use of negotiation automation and improved client portals is expanding, improving efficiency and transparency.

Buy Your Sample Report Now@ https://straitsresearch.com/buy-now/debt-settlement-market

Frequently Asked Questions (FAQs)

Q: What is the difference between debt settlement and debt consolidation?

A: Debt settlement negotiates with creditors to reduce the amount owed; consolidation combines multiple debts into one loan that is repaid in full with interest.

Q: Will debt settlement hurt my credit?

A: Yes. Settlements usually require missed payments before negotiations, and accounts show as “settled” rather than “paid in full,” which can temporarily lower credit scores.

Q: How much can I expect to save?

A: Savings typically range from 20% to 60% of enrolled unsecured debt, depending on creditor cooperation and account status.

Q: Are fees charged up front?

A: Reputable firms usually charge fees only after a successful settlement is reached. Avoid companies demanding large up-front payments.

Q: Is the debt settlement industry regulated?

A: Yes. Federal and state laws regulate practices, disclosures, and fee timing. Consumers should always review compliance and company credentials.

Conclusion

The debt settlement market remains a key part of consumer financial services. Despite regulatory hurdles and reputational challenges, it continues to grow due to high consumer debt levels and the demand for affordable relief options. The future of the industry lies in adopting advanced technologies, forming partnerships with fintech companies, and expanding into new geographies. For consumers, selecting a transparent and compliant provider is critical to achieving the best possible outcome.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

Contact Us

Phone: +1 646 905 0080 (U.S.), +44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com