Forklifts remain a critical backbone of industrial logistics, warehousing, and construction worldwide. These versatile vehicles have evolved significantly, integrating advanced automation, sustainable power sources, and smart technologies to meet growing demands for efficient and eco-friendly material handling. As supply chains become complex and e-commerce soars, forklifts are adapting with battery innovations, autonomous navigation, and digital connectivity. Industry giants and emerging players alike are racing to innovate and expand their global footprint.

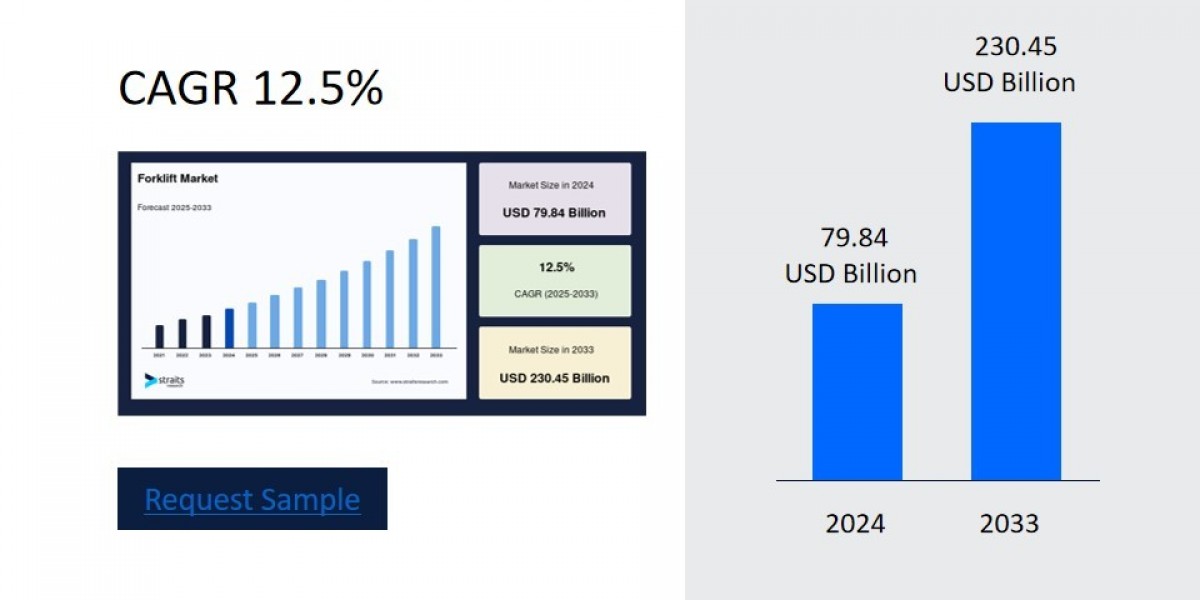

According to Straits Research, the global forklift segment was valued at USD 79.84 billion in 2024 and is expected to grow from USD 89.82 billion in 2025 to reach USD 230.45 billion by 2033, growing at a CAGR of 12.5% during the forecast period (2025-2033).

Market Leaders and Their Innovations

Japan’s Toyota Industries Corporation continues to dominate the forklift sector with its robust engineering, comprehensive portfolio of internal combustion and electric forklifts, and pioneering automation solutions. Toyota’s focus on safety, telematics integration, and lithium-ion battery technology has strengthened its leadership, especially in North America, Europe, and Asia.

Germany's KION Group, owning brands like Linde, STILL, and Baoli, is another powerhouse driving electrification and warehouse automation. They have invested heavily in intralogistics digitalization and autonomous guided vehicle (AGV) development, enhancing material handling efficiency across Europe and Asia.

Jungheinrich AG from Germany specializes in electric forklifts and intralogistics system integration. It has positioned itself as a full-service provider, coupling innovative battery and fleet management systems with automation tools.

Japan’s Mitsubishi Logisnext operates multiple brands including Mitsubishi Forklift Trucks and Cat Lift Trucks. Their global reach and broad portfolio emphasize ruggedness, reliability, and environmentally friendly power solutions.

Among American contenders, Hyster-Yale delivers cost-effective forklifts focused on durability and productivity, expanding its alternative energy-powered forklift lineup to cater to increasing eco-regulations.

South Korea’s Doosan Industrial Vehicle and Japan’s Komatsu Ltd. further emphasize robust and heavy-duty forklifts while investing in smart logistics and green technologies.

Chinese Manufacturers Rising

Chinese manufacturers are transforming the global forklift landscape. The largest, HELI (Anhui Heli Co., Ltd.), ranks consistently in the global top 10 and offers an extensive lineup of internal combustion and electric forklifts, leveraging competitive pricing and expanding global distribution.

Hangcha Group, BYD Forklift, known for its lithium iron phosphate battery technology, Lonking, and EP Equipment, specializing in lithium-ion powered forklifts, are rapidly enhancing the quality, energy efficiency, and technological sophistication of their fleets, targeting both domestic growth and international expansion.

Trends Driving Growth and Innovation

Electrification remains the most dominant trend. Many operators prefer electric forklifts as they offer lower emissions, reduced noise, and lower operating costs compared to traditional internal combustion engines. Lithium-ion batteries with quick charge times and extended cycles are making electric forklifts more practical and cost-efficient than ever.

Automation and smart technologies are reshaping operations. Autonomous forklifts and AGVs equipped with sensors, cameras, and AI software enable safer, more flexible material handling in warehouses and factories with minimal human intervention.

Integration with fleet management software and telematics allows real-time data collection and predictive maintenance, reducing downtime and boosting productivity. Companies are increasingly adopting digital tools for route optimization and energy management.

The COVID-19 pandemic accelerated investment in automation and touchless material handling to reduce worker contact and enhance operational resiliency within supply chains.

Regional Updates and Growth Outlook

Asia-Pacific holds the largest share in forklift sales, driven largely by China, Japan, and India’s booming industrial and manufacturing sectors. China is positioning itself as a manufacturing hub for electric forklift innovation and energy-efficient solutions.

North America, led by the United States, is a major market for electric and automated forklifts, with increased adoption in e-commerce fulfillment centers and logistics. The region is witnessing steady regulatory push towards electrification.

Europe emphasizes sustainability, with Germany, France, and the UK driving demand for energy-efficient and emission-free forklifts, alongside investments in automation and digital fleet management systems.

Emerging markets in Latin America and the Middle East are experiencing rising forklift demand due to expanding infrastructure and industrialization, fostering new growth opportunities.

Recent News Highlights

In May 2025, PALFINGER unveiled a modular, center-seat truck-mounted forklift at the bauma trade fair, emphasizing versatility and operator safety for construction and industrial applications.

In March 2025, UN Forklift introduced five new models covering electric 3-wheel and rough-terrain hydrostatic designs aimed at improving agility and efficiency in warehouse operations.

July 2024 saw Hyster release the E80XNL 8,000-lb electric forklift featuring an integrated lithium-ion pack, combining heavy-duty performance with emissions-free operation.

Chinese leaders HELI and Hangcha have expanded their global distribution networks and invested in electric and autonomous forklifts to compete with established Western giants internationally.

Outlook

The forklift segment is poised for significant growth as electrification, automation, and digitization become industry imperatives. With strong competition driving innovation, companies invest heavily in green technologies and smart systems for safer, more flexible material handling.

The growing e-commerce sector, warehouse automation, and environmental regulations ensure sustained growth, particularly for electric and autonomous forklifts. Increased integration of IoT and AI for fleet tracking and predictive maintenance will help companies optimize operations and reduce total cost of ownership.