Balers, essential for compressing and packaging materials from crops to recyclables, are powering a new era in agriculture, industry, and waste management. Once limited mostly to farms, these machines are now at the center of solutions for efficient handling, sustainability goals, and urban waste challenges, responding to rising global needs in agricultural productivity, recycling, and bioenergy.

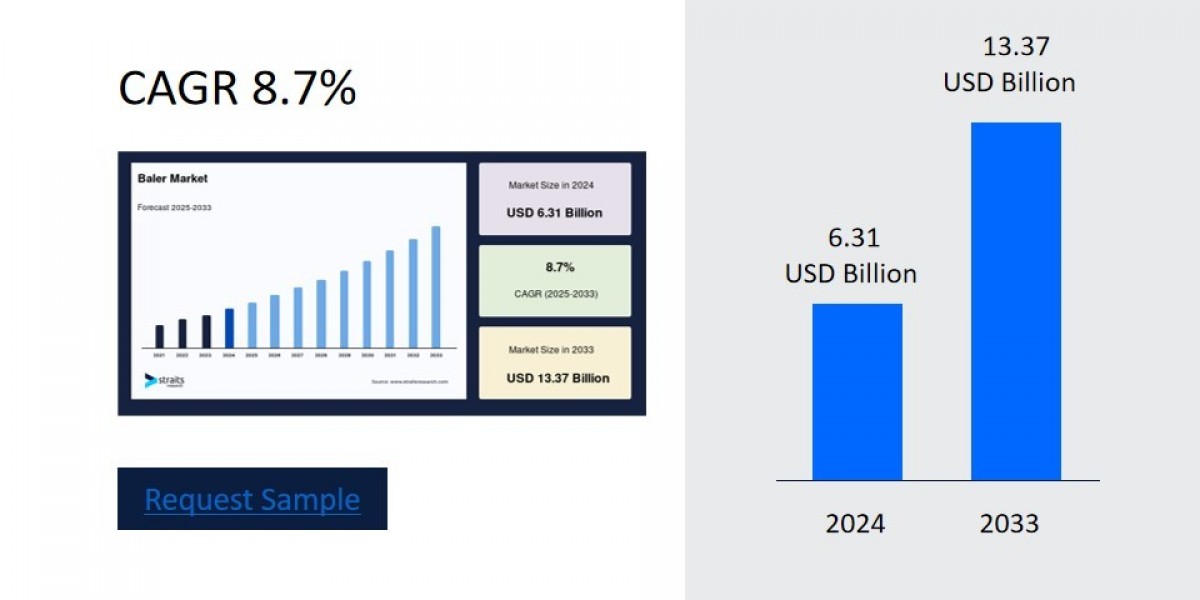

According to Straits Research, the global baler segment was valued at USD 6.31 billion in 2024 and is expected to grow from USD 6.86 billion in 2025 to USD 13.37 billion by 2033, with an impressive CAGR of 8.7% over the forecast period (2025–2033).

Latest Developments and Growth Drivers

Recent years have seen major technological leaps. The push towards smart farming and sustainable cities has driven manufacturers to introduce IoT-enabled balers that monitor material, automate maintenance, and maximize fuel efficiency. This has reduced downtime and labor needs, while boosting productivity.

One of the main trends is an ever-widening array of baler applications. Urban recycling programs and food processing facilities are rapidly adopting balers to compact plastics, cardboard, and food packaging. In agriculture, baler automation has increased harvesting efficiency by nearly 30% in some regions, transforming crop management and opening new opportunities in bioenergy and eco-friendly products. Demand for ready-to-eat food is further fueling uptake, as balers help manage packaging waste efficiently and safely.

Regions with expanding farms, more livestock, and newer waste management laws—especially in North America, Europe, China, and India—are showing the fastest growth. Horizontal balers that handle a range of materials are dominating due to their versatility and operational benefits, boosting recycling rates and reducing labor costs.

Key Players and Innovations

Top companies continue to compete through innovation and regional expansion. Names like John Deere (USA) and New Holland Agriculture (Italy/USA) have launched advanced smart balers with digital monitoring and automation. In 2024, John Deere introduced connected balers designed for integration with fleet management systems, helping farms and recycling facilities optimize logistics and resource use.

Vermeer Corporation (USA) rolled out the ZR5-1200 self-propelled baler, winning industry awards for efficiency and operator safety. CLAAS (Germany) invested in energy-efficient, ergonomic designs and improved safety features for global distribution, responding to increasingly strict workplace standards. Kubota (Japan) focused on compact, low-emission balers that fit urban environments and smaller farms, reflecting a shift towards flexible and environmentally friendly machines.

India has rapidly emerged as a significant market, with companies like Mahindra & Mahindra making balers affordable and accessible for smaller farms. China is positioned to become the global leader in baler sales by 2030, driven by government programs for rural modernization and urban recycling initiatives.

Global and Country-Wise News

In North America, an innovation wave continues as U.S. and Canadian producers adopt the latest baler technology for both agricultural and recycling purposes. These machines have been essential in meeting new regulatory requirements for waste reduction and biofuel production.

Europe leads in environmental regulation, where Germany, France, and the UK favor balers with higher energy efficiency and digital traceability. The region’s focus on circular economy principles has pushed manufacturers to offer models compatible with different crop types and recyclable materials.

Asia-Pacific represents the fastest-growing region, with China projecting market dominance and India’s segment growing at an impressive 12.7% CAGR through 2030. Both countries see rapidly modernizing farms, booming e-commerce packaging needs, and large-scale government initiatives to support mechanization and sustainability.

In Latin America and the Middle East, countries like Brazil and Saudi Arabia are embracing balers as part of comprehensive agricultural and waste management modernization programs, often through public-private partnerships and international collaborations.

Recent Company Announcements

In 2025, Vermeer launched silage balers with new control platforms that simplify operation and broaden application in larger-scale feed and bioenergy production facilities.

New Holland unveiled balers featuring Pro-Belt technology, with variable chamber options to meet diverse crop processing needs. These machines now come equipped with automatic greasers, service lights, and digital interfaces for improved reliability and processing flexibility.

Major industry players focused heavily on research and development, pushing next-gen models with reduced maintenance requirements and higher throughput to meet the evolving needs of commercial operators worldwide.

Future Direction and Industry Outlook

The baler segment’s future lies in intelligent automation, multifunction capability, and green design principles. More sectors are embracing balers—urban planners, recycling centers, food processors—all demanding machines that deliver both operational savings and carbon footprint reduction. Digital platforms and blockchain for supply chain traceability are emerging, offering transparency and authenticity for agricultural and recyclable output.

As industry regulations evolve, companies are expected to invest further in energy efficiency and connectivity, integrating baler fleets with enterprise resource planning (ERP) and maintenance management systems for maximum asset utilization.