Automotive connectors are the backbone of modern vehicular electronics, facilitating seamless communication between myriad subsystems and ensuring both efficiency and safety on the road. As vehicles become more electric and intelligent, robust connector solutions are critical for everything from power management to infotainment, supporting advances like electrification, automation, and ADAS (Advanced Driver-Assistance Systems). This increasingly complex landscape is prompting innovation, investment, and strategic collaboration across continents.

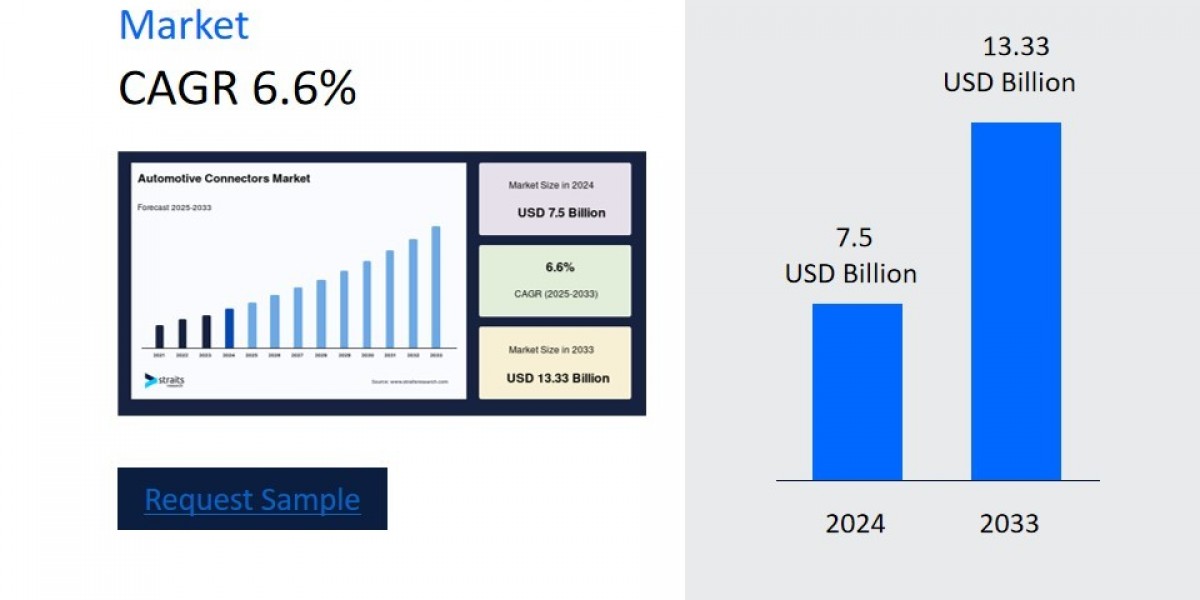

According to Straits Research, the global automotive connectors market size was valued at USD 7.5 billion in 2024 and is expected to grow from USD 8 billion in 2025 to reach USD 13.33 billion in 2033, growing at a CAGR of 6.6% over the forecast period (2025-2033).

Key Trends and Technology

The latest connector designs focus on miniaturization, ruggedness, and high-current density, reflecting the pressing need for space-saving and high-performance solutions in tightly packed automotive electronic architectures. Miniaturized connectors are increasingly in demand for electric vehicles (EVs) and advanced infotainment systems, while ruggedness is pivotal for vehicles operating in harsh climate and terrain conditions. Advanced materials, such as lightweight aluminum and plastic composites, are replacing traditional options to deliver both durability and improved thermal management—crucial as vehicle power and data consumption rise.

Adoption of optical fiber connectors and high-frequency connectors is accelerating, with optical technology enhancing high-speed data transfer for next-generation, sensor-rich vehicle platforms. Simultaneously, industry-wide initiatives center on boosting sustainability, reducing resistance for higher energy efficiency, and integrating AI-powered intelligent systems for predictive maintenance and active safety.

Key Players and Global Developments

Prominent manufacturers driving this evolution include:

TE Connectivity (Switzerland/USA): The company leads with a 22% market share in data connectors, broad automotive portfolios, and leadership in sustainability. In March 2025, TE Connectivity agreed to acquire Richards Manufacturing (USA), reinforcing its capability in underground utility networks and grid connection technologies.

Yazaki Corporation (Japan): Focuses on battery pack connection modules and waterproof connector technologies, reflecting Japan’s push for robust EV solutions.

Aptiv PLC (Ireland/USA): Known for sensor-rich, modular automotive connectors and vertical integration into adjacent electronic components.

Amphenol (USA): Expanded its footprint with the acquisition of Carlisle Interconnect Technologies, prioritizing integration with HVAC and high-voltage applications.

Leoni (Germany): In February 2025, Leoni launched a major wiring systems plant in Morocco, supporting electrification for commercial and passenger vehicles in EMEA.

Molex (USA), Rosenberger (Germany), Hirose Electric (Japan), and Yueqing Haidie Electric (China): Drive regional innovation with specialized connectors, with Rosenberger and Hirose focusing on high-performance and customized solutions.

The industry also sees China’s Yueqing Haidie Electric cementing its position with competitive, locally developed wire harnesses tailored to the EV explosion in Asia, demonstrating the global reach and local specialization of the connector sector.

Regional and Recent Updates

Europe: Investments are strong in Germany and Morocco, where German firms are localizing wire harness and connector production to meet surging European EV and truck demand.

North America: US-based Molex and Amphenol are expanding their global reach through new supply chain partnerships and acquisitions, addressing growing utility and automotive infrastructure needs.

Asia: Japanese and Chinese players dominate EV connector innovation and value manufacturing, ensuring regionally resilient supply chains in the face of global disruptions.

In March 2025, Harwin (UK) began construction on a £30 million eco-friendly manufacturing facility, focusing on high-reliability industrial and automotive connectors, with extensive green design for sustainability. Meanwhile, companies like DigiKey in the US expanded their network to include over 1.1 million products, with automotive and energy as core new focus areas for 2025.

Industry News and Innovations

Partnerships and Acquisitions: March 2025 saw TE Connectivity bolster its infrastructure expertise, Harwin expand its sustainable manufacturing footprint, and DigiKey add major brands and products aimed at the automotive sector.

R&D Developments: TE Connectivity launched the GRACE INERTIA connector—specifically engineered for compact, high-performance automotive and smart infrastructure uses. Yazaki recently filed new patents for waterproof, high-voltage connectors, targeting electric taxis and commercial fleets in Japan.

Distribution and Ecosystem Growth: Companies like Samtec and Qorvo secured major distribution agreements to get advanced connectors into more markets, responding to the growing demand for efficient, high-integrity interconnects in both automotive and adjacent automation sectors.

Sector-wide Growth and Outlook

The electrification wave and the rollout of autonomous technologies are propelling demand for high-voltage, intelligent connectors, while OEMs push for vertical integration and partnerships that support modular, software-defined vehicle architectures. AI-driven manufacturing, automated assembly, and supply chain resilience (with initiatives like Molex’s Mini Reel Program) are addressing traditional bottlenecks and inventory risks. Sustainability is also a top priority—companies are integrating renewable energy into facilities, reducing emissions, and launching product lines designed for carbon efficiency.

Conclusion

Riding the momentum of digitalization, electrification, and AI-driven innovation, automotive connectors are evolving rapidly. With leading companies expanding across continents and new technologies reshaping safety, efficiency, and user experience, the sector is poised for robust expansion through 2033.